The training, fraud resources and continuing education provided by the Association of Certified Fraud Examiners (ACFE) will help in any stage of your career path.

They often assist senior management in defining business strategies that avoid or mitigate risks. The study also provides valuable information and comparisons helpful to all anti-fraud professionals in benchmarking their compensation levels and career growth. The risk manager’s job is to evaluate input from all available sources and then quantify risks for senior decision-makers in the company. The ACFE’s Global Salary Study found that CFEs earn a 34% income premium over their peers without the credential, which demonstrates the value employers place on the credential. Candidates who have earned their CFE credential are regarded as leading experts in the field, making them more preferential to many employers. Additionally, it ensures risk management professionals have the necessary tools to identify, assess, monitor and control fraud risk.

The CFE credential provides risk management professionals with the knowledge to detect and deter fraud by identifying unusual trends and fraud indicators in the organization’s processes and operations. Doing so can have an impact on the amount of funding allocated to risk management activities, and may also convince management to avoid certain strategic alternatives due to their risk profiles.Fraud risk affects all organizations. Present the risk profile and risk mitigation plans to the board of directors at regular intervalsĪ more successful risk manager should be able to estimate the financial impact of certain risks if they come to pass, and convey these projections to senior management. Maintain records relating to all incidents and insurance claimsĮvaluate new risk management techniques and recommend them to management as appropriate Manage relations with all insurance providers

#Enterprise risk manager job description full

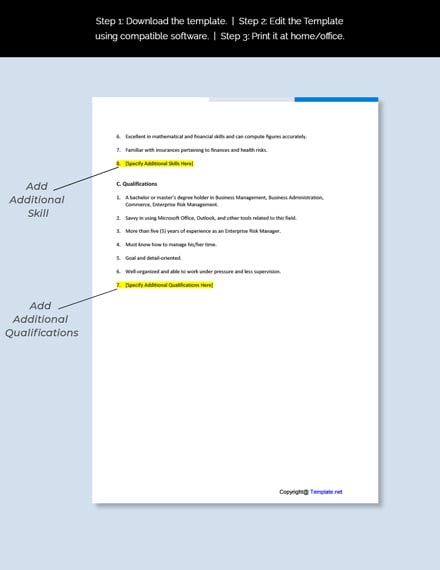

Monitor the probability of loss from all types of risksĮnsure that the company is in compliance with all government regulations relating to its insurance coverageĭesign methods for the mitigation of losses, such as through outsourcing of operations, changes to work instructions, or the procurement of insurance The Risk Management Officer is responsible for ensuring the Bank maintains an adequate and effective Enterprise Risk Management (ERM) program thus ensuring the Bank is in full compliance with all banking laws, rules, regulations, and internal policies, procedures and processes. In more detail, the job description of the risk manager encompasses the following:ĭetermine the nature of all risks to which the company is subjected, and monitor operations to spot changes in these risks Develop Enterprise Risk Management tools, practices, and policies to identify. The risk manager should also be cognizant of risk issues that have impacted other companies in the industry, and explore whether those issues could impact the company at a later date. Establish risk ownership of identified risks and monitor the risk mitigation. He or she should also have a detailed knowledge of prior accidents, lawsuits, and claims, and the reasons for those incidents. Maintain reports of significant risks and recommendations. Analyze transactions, internal reports and financial information for potential fraud risks. In general, the risk manager should be thoroughly versed in the industry within which the company operates, as well as the facilities, processes, and products of the company. Responsibilities for risk management professionals include: Establish and monitor key risk indicators, as well as implement corrective action plans to mitigate risks. Thus, the risk manager position should be considered a mid-level management position. The position usually reports to the chief financial officer, but may also work closely with many parts of the company, including engineering, human resources, legal and accounting, production, safety and health, and security. The risk manager position is responsible for the monitoring and mitigation of all risks within a company.

0 kommentar(er)

0 kommentar(er)